The Single Strategy To Use For Pvm Accounting

Table of ContentsSee This Report on Pvm AccountingThe Definitive Guide to Pvm AccountingHow Pvm Accounting can Save You Time, Stress, and Money.Facts About Pvm Accounting RevealedPvm Accounting Can Be Fun For AnyoneThe 4-Minute Rule for Pvm Accounting

Manage and manage the creation and approval of all project-related payments to consumers to cultivate good interaction and avoid problems. financial reports. Guarantee that suitable records and paperwork are submitted to and are updated with the internal revenue service. Guarantee that the accounting procedure conforms with the regulation. Apply required building audit criteria and procedures to the recording and coverage of building and construction activity.Interact with different funding companies (i.e. Title Firm, Escrow Business) pertaining to the pay application procedure and demands required for payment. Aid with executing and preserving internal monetary controls and treatments.

The above declarations are planned to describe the general nature and degree of job being executed by people designated to this classification. They are not to be interpreted as an exhaustive listing of obligations, duties, and skills called for. Workers might be called for to carry out tasks outside of their regular responsibilities once in a while, as required.

The 30-Second Trick For Pvm Accounting

You will certainly help sustain the Accel group to guarantee delivery of successful on time, on budget, tasks. Accel is seeking a Construction Accounting professional for the Chicago Office. The Building and construction Accounting professional does a variety of audit, insurance policy compliance, and task administration. Functions both individually and within certain divisions to keep monetary documents and ensure that all documents are kept existing.

Principal tasks consist of, but are not restricted to, dealing with all accounting functions of the company in a prompt and precise manner and offering reports and routines to the firm's CPA Firm in the prep work of all financial statements. Makes certain that all accounting procedures and features are managed properly. In charge of all financial documents, payroll, banking and day-to-day operation of the bookkeeping function.

Prepares bi-weekly trial balance records. Functions with Job Supervisors to prepare and upload all month-to-month billings. Processes and problems all accounts payable and subcontractor repayments. Generates month-to-month recaps for Employees Payment and General Responsibility insurance costs. Creates regular monthly Job Expense to Date reports and collaborating with PMs to integrate with Project Supervisors' budgets for each job.

The Single Strategy To Use For Pvm Accounting

Proficiency in Sage 300 Construction and Actual Estate (formerly Sage Timberline Workplace) and Procore building and construction monitoring software program a plus. https://cream-marigold-kdrvzg.mystrikingly.com/blog/mastering-construction-accounting-your-ultimate-guide. Have to additionally excel in various other computer software systems for the preparation of reports, spreadsheets and other accountancy evaluation that might be called for by administration. construction accounting. Need to possess solid organizational abilities and ability to focus on

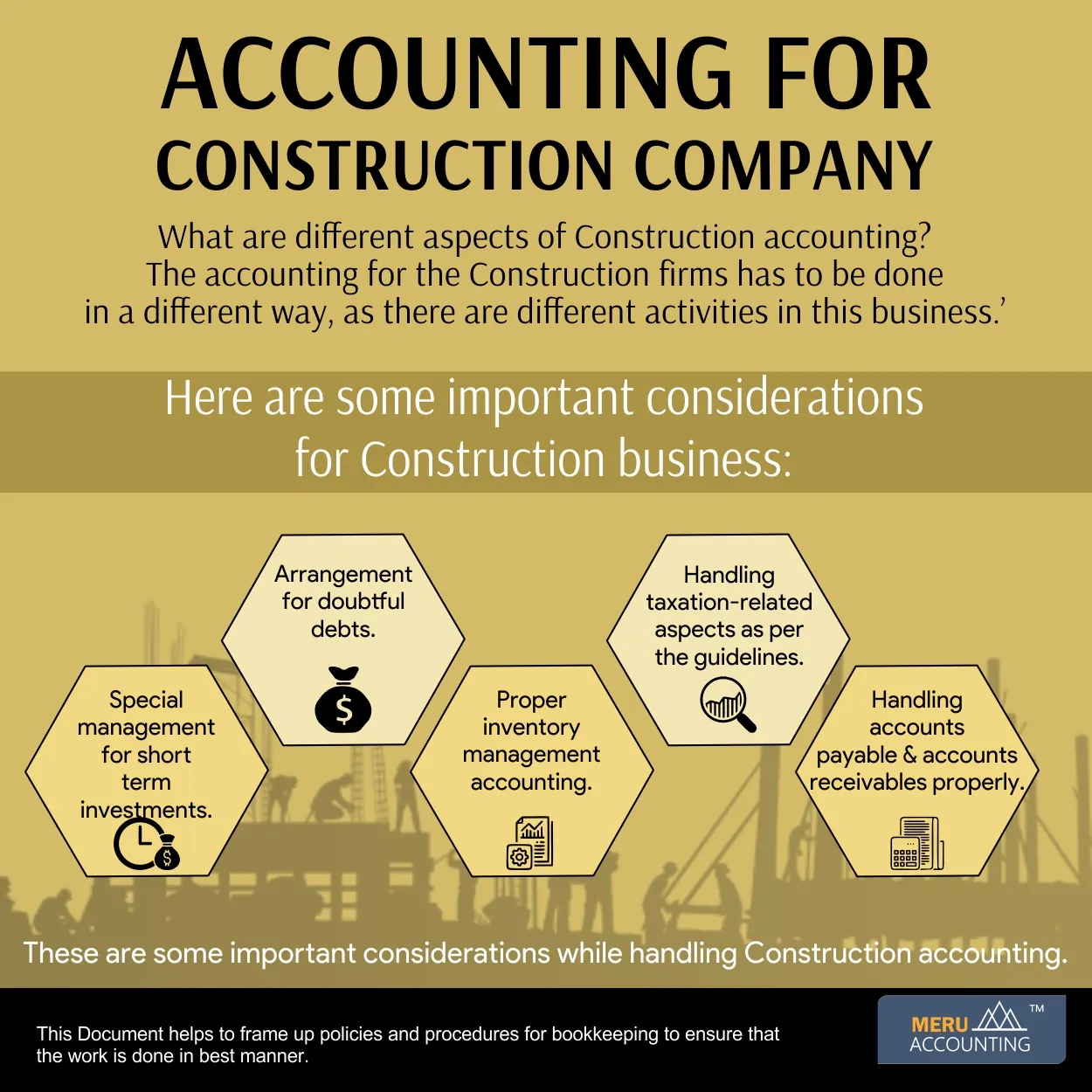

They are the financial custodians who make certain that building and construction projects helpful resources continue to be on budget plan, follow tax obligation laws, and maintain monetary transparency. Building accounting professionals are not just number crunchers; they are strategic companions in the construction process. Their primary role is to handle the economic facets of building jobs, making certain that resources are designated effectively and financial dangers are decreased.

Not known Facts About Pvm Accounting

By preserving a tight grasp on project financial resources, accounting professionals help stop overspending and financial troubles. Budgeting is a foundation of successful construction jobs, and building and construction accountants are crucial in this regard.

Navigating the facility web of tax obligation laws in the building industry can be tough. Construction accounting professionals are well-versed in these regulations and make certain that the task follows all tax obligation needs. This consists of managing pay-roll taxes, sales tax obligations, and any kind of various other tax obligation responsibilities details to building and construction. To succeed in the role of a building accountant, people require a solid educational structure in audit and money.

In addition, accreditations such as Qualified Public Accountant (CPA) or Certified Building Market Financial Specialist (CCIFP) are highly pertained to in the industry. Working as an accountant in the building sector includes an one-of-a-kind collection of difficulties. Construction jobs often involve tight due dates, altering regulations, and unexpected expenses. Accountants need to adjust rapidly to these obstacles to maintain the project's financial health undamaged.

The Greatest Guide To Pvm Accounting

Ans: Building accounting professionals create and check budgets, identifying cost-saving opportunities and making sure that the task remains within budget. Ans: Yes, building and construction accounting professionals manage tax conformity for construction projects.

Intro to Building Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction business need to make difficult options among lots of financial alternatives, like bidding on one task over one more, selecting financing for products or equipment, or establishing a task's revenue margin. In addition to that, building and construction is an infamously volatile market with a high failure price, slow-moving time to settlement, and irregular cash money flow.

Production involves duplicated procedures with quickly identifiable prices. Manufacturing needs various processes, materials, and tools with differing costs. Each task takes area in a new area with differing website problems and unique obstacles.

How Pvm Accounting can Save You Time, Stress, and Money.

Constant use of different specialized service providers and vendors impacts effectiveness and cash money flow. Settlement shows up in full or with regular payments for the complete agreement amount. Some portion of repayment may be kept up until project conclusion even when the specialist's work is ended up.

Routine manufacturing and temporary contracts lead to workable capital cycles. Uneven. Retainage, slow payments, and high ahead of time costs bring about long, irregular capital cycles - construction bookkeeping. While typical makers have the advantage of controlled settings and optimized manufacturing procedures, building firms have to regularly adapt to every new job. Also somewhat repeatable jobs call for modifications because of website problems and other elements.